Claiming depreciation and using a Pay As You Go withholding variation can increase your fortnightly cash flow

Though investors often use negative gearing to offset the costs involved with owning a property, most have the aim to eventually use the property primarily as a source of income and to generate wealth.

Property investors evaluating their current financial position and considering what options they can take to improve the cash flow gained from their investment should consider a Pay as You Go withholding variation (PAYG).

What is PAYG?

The PAYG method of tax collection was introduced in July 2000. This method replaced previous versions of the same system, such as Pay as You Earn (PAYE). The PAYG system allows investors to take advantage of deductions regularly, rather than in one lump sum at the end of the financial year.

The PAYG variation estimates your expected tax refund for the financial year and allows your employer to take less tax out of your wages. An Accountant will usually organise the PAYG variation by submitting estimated financial information to the Australian Taxation Office (ATO). This can be done at any time during the year. For property investors, the tax liability is reduced based upon the anticipated deductions like interest, maintenance, rates, and depreciation on a rental property.

Once a request has been made, the property owner’s employer will reduce the amount of tax withheld therefore increasing their take home pay in each pay packet.

It is important to note that submitting the PAYG variation does not replace a normal tax return. A tax return still needs to be filed at the end of the year to calculate the actual amount of tax liability.

Property depreciation adds value to PAYG withholding variation

Maximising property depreciation and capital works deductions will increase the cash return for property investors. Property depreciation will strengthen the PAYG withholding variation by reducing the investor’s taxable income.

As depreciation is a non-cash deduction; nothing needs to be spent to claim it. The ATO allows investment property owners to claim property depreciation due to the wear and tear and decline in value of a building and its fixtures over time.

To support your PAYG application, a specialised Quantity Surveyor can produce a property depreciation schedule for property investors. The property depreciation schedule will outline all current and future depreciation deductions for an investment property. Under the PAYG system, the higher depreciation deductions are the less tax an individual needs to have taken from their regular pay packet.

By obtaining a depreciation schedule straight after purchasing an investment property, the new owner can maximise returns immediately through the PAYG withholding variation.

A PAYG withholding variation provides added flexibility for property investors. Having access to the extra money during the year will make it easier to manage cash flow especially when there can be surprise costs. This also provides an opportunity for the property owner to invest the extra money or reduce loan liabilities.

Example case study

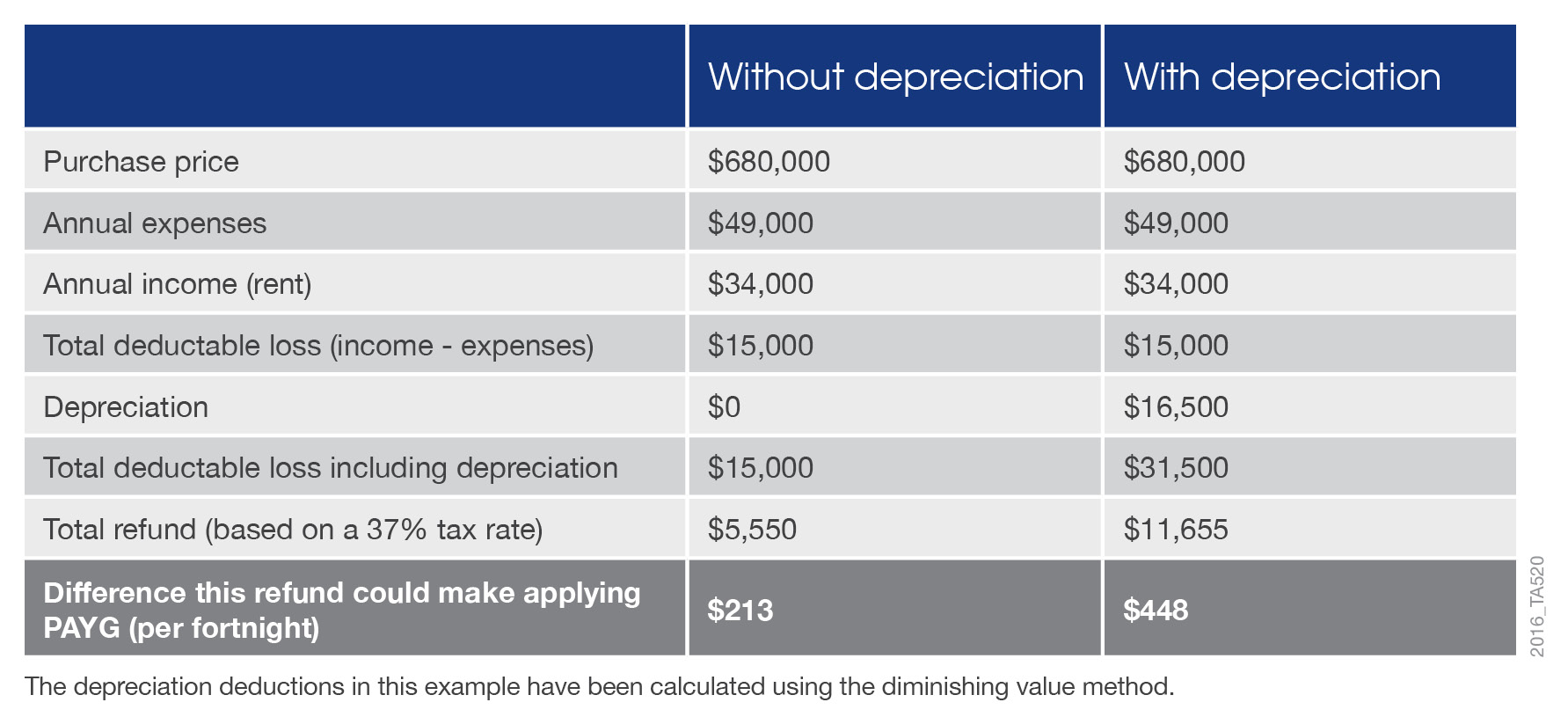

The following example shows the difference that claiming depreciation made in the first financial year, for the owner of a two bedroom inner city apartment purchased for $680,000. This apartment attracts a typical depreciation claim of $16,500 in the first full financial year. Annual expenses include interest, mortgage payments, management fees, repairs and maintenance.

This example shows a difference of $6,105 per annum by applying property depreciation. Under the PAYG system the investment property owner will receive an additional $235 in their pay packet by claiming depreciation.

Speak with a depreciation expert

A PAYG withholding variation makes a difference to a property investor’s regular cash flow. A specialist Quantity Surveyor can add to this by providing a property depreciation report before you submit a PAYG variation request. Quantity Surveyors are one of the few professionals qualified under the Tax Ruling 97/25 to estimate construction costs for property depreciation purposes.