As property investors sit back and relax in their own backyards this summer, they should also think about the outdoor areas of their investment properties.

It’s the perfect time of year to check with your Property Manager to make sure there are no necessary repairs or maintenance required and to consider whether updating the yard could add value for existing or potential tenants. Any work done to the property could improve the rental return and may also impact the depreciation deductions that can be claimed.

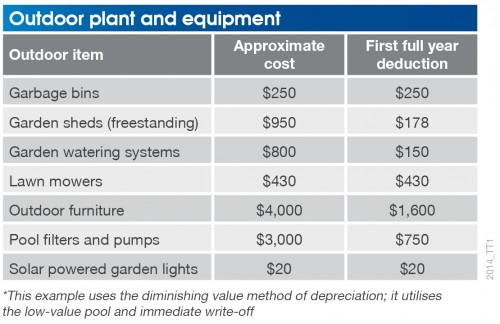

Deductions for outdoor items are amongst those most likely missed by investors. Plant and equipment assets such as garbage bins, solar powered garden lights, garden watering systems, pool filters, freestanding garden sheds, automatic window shutters and water feature pumps are just some of the items investors often fail to claim. Depreciation for each plant and equipment item can be claimed based on the individual effective life as set by the Australian Taxation Office (ATO).

There are a couple of exceptions. Items which cost $300 or less will entitle owners to an immediate write-off in the first financial year claim and items which cost $1,000 or less or are valued at $1,000 or less after previous years claims can be added to a low-value pool and depreciated at an increased rate of 18.75% in the first year and 37.5% from the second year onwards.

The below table shows what some of the depreciable assets outside an investment property could be worth to an investor at tax time.

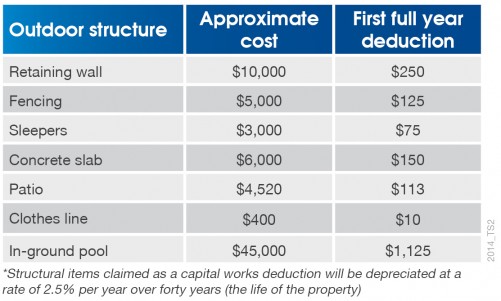

Investors are often unaware of the deductions they can claim for structural items in the yard such as retaining walls, clothes lines, fences and in-ground pools. Claims for these items are based on the historical cost of the structure and claimed as a capital works deduction.

The following table provides examples of the deductions an investor can claim in the first full financial year.

Before an investor arranges any repairs, maintenance or improvements to be made to areas outside of their property, it is important they understand how repairs, maintenance and improvements are each treated differently by the ATO.

For example, if the work being completed is to fix damage such mending part of a fence or replacing guttering damaged in a storm, this will be considered a repair. Work completed to prevent deterioration of the property, for example oiling decking on an outdoor entertaining area, is considered maintenance. Deductions for repairs and maintenance can be claimed by the investor in full within the same financial year that the cost was incurred.

However, if the work done to an item improves the condition or value of an item beyond its original state at the time of purchase, it is considered to be a capital improvement. Capital improvements are classified as either capital works deductions or plant and equipment. So if the owner was to replace the entire fence of a residential investment property, this would be claimed as a capital works deduction.

Before making any capital improvements or renovations that could increase the value of existing items in the yard, it is best to speak with a Quantity Surveyor. They will be able to perform a site inspection of the property before work begins to record both structural items and plant and equipment contained in the yard before they are removed and scrapped. This is important as the owner may be entitled to claim the remaining depreciable value of items being removed and scrapped.

After any work is done to the property, investors should also organise for a specialist Quantity Surveyor to come and perform an inspection to list all new structures and assets and the depreciation that can be claimed by the owner for the remaining life of the property.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Managing Director of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.