A common question asked by property investors regarding tax depreciation is, “Why does a unit obtain more depreciation deductions than a house?”

When determining depreciation deductions available in a property, factors which affect calculations include: purchase price of the property, date which construction commenced, settlement date, land value (where relevant) and the value of fittings and fixtures within the property.

The overall cost to build residential units increases due to the amount of infrastructure involved in walls, services, etc by comparison to the less compact layout of a house or residential property. This can make a significant difference to the overall claim.

Units also often contain more fixtures and fittings than a house. Owners of a unit not only can claim items within the strata unit (i.e. lights, carpet and dishwashers). They are also entitled to claim their share of the common property. Common property has been identified by the Australian Taxation Office (ATO) as areas within a complex or development that are shared between owners. This includes areas and items such as driveways, pools and pool pumps, outdoor furniture, lifts and common fire stairways.

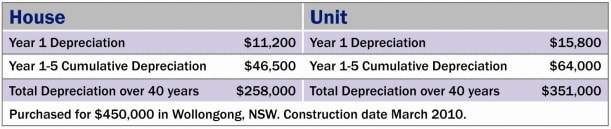

The following example compares a unit and a house (both with the same purchase price, construction date and settlement date), there is a difference of $15,000 in depreciation deductions over the first five years of ownership.

The ATO’s legislation recognises quantity surveyors as qualified to estimate construction costs for depreciation purposes. As a building gets older its items wear out; they depreciate in value. The ATO allows property owners to claim this depreciation as a tax deduction. Depreciation can be claimed by any property owner who obtains income from their property.

While most investors are aware they can claim deductions on the building structure of a unit (subject to age) and the plant and equipment items within, such as blinds, carpets, ovens, range hoods and the like, many investors are unaware they can claim on common areas as well. Therefore, it is worthwhile for investors to consult a professional quantity surveyor to calculate the most accurate and financially rewarding return for the property investor.

Accountants and real estate agents may on occasion estimate depreciation figures, but such professions lack construction cost knowledge and the capability to accurately determine the depreciation deductions available in an investment property. Most importantly the ATO does not recognise their figures in a tax return. Consulting a quantity surveyor who specialises in depreciation will guarantee the investor gets the maximum legitimate deductions available.

More than likely a site inspection will take place to allow the quantity surveyor to establish the maximum number of plant and equipment items within the property. Measurements, photos and notes are taken to enhance the depreciation report. If an investor is audited by the ATO, their depreciation claim will be supported by evidence documented at the time of inspection.

A quantity surveyor can determine the correct proportion a unit owner is entitled to claim for common property based on criteria such as the size, position within the development (eg. penthouse or ground floor) and even its view based on relevant building plans.

Once a quantity surveyor has been engaged to complete a tax depreciation report on an investment property, any fee associated with the production of that report is 100% tax deductible.

Article Provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Managing Director of BMT Tax Depreciation