BACKGROUND

Sometimes you know you really need to take action…but fear holds you back. So many of our clients make the decision to invest in property and when they do their reaction is “that was easy” or “I’ve been thinking about doing this for years, but I …..”

The perfect example of this is one of our staff members, “Rachal”. We drastically improved the outlook of her financial future, by overhauling her current finance structures and beginning an investment portfolio.

She is a single woman who has been with us for over six years. In this time Rachal has seen hundreds of people make tens of thousands of dollars by investing in property. Rachal has seen prices go up, properties leased and customers buy five or six investments in this time. She has daily conversations with our mortgage brokers and financial planners and has heard me bang on about doing something for herself time and time again.

So despite being in the box seat surrounded by knowledge and encouragement, FEAR held her back and she elected to play it safe and do nothing.

Finally, in 2013 after five and a half years, Rachal was planning her 40th birthday and decided that “a man is not a financial plan”. She then sat with our team and became a client of Buy Property Direct.

This is how things played out for her…

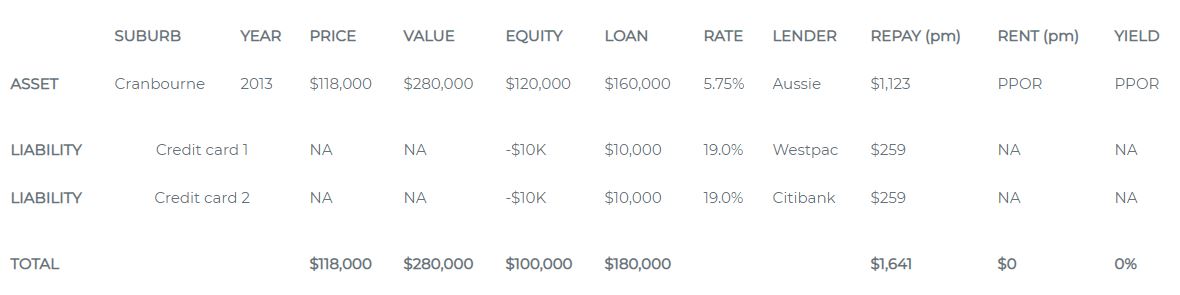

REVIEW OF CURRENT POSITION

Rachal lives in a unit in Cranbourne that she purchased in 2003 for $118,000 it is now worth around $280,000. (In another 10 years at 7.2% average growth it will be worth $560,000).

She was paying off two credit cards at $259pcm and $259pcm so her total monthly commitments were $1,641pcm.

THE STRATEGY

The strategy was to first reduce her current repayments (good and bad debt) to maximise her cashflow and borrowing capacity. This involved re-financing her home with a different lender to access a better rate, but also consolidating her two credit card debts into her home loan thus a lower-interest environment. This substantially improved her month-to-month disposable cash, which generated her ability to afford a second mortgage (i.e.: an investment property). Rachal had a good equity position in her existing home, so we unlocked $30,000 equity to fund a deposit/costs for an investment property, which avoided her having to save physical cash or dip into existing savings.

She then purchased a 3-bedroom unit for $365,000, which was brand new and off-the-plan in the high growth/low vacancy suburb of Somerville, VIC. She saved thousands in stamp duty through buying before construction, and accessed maximum depreciation, which optimises her tax benefits. The investment was rented before settlement, and is returning $1430pcm (net of fees).

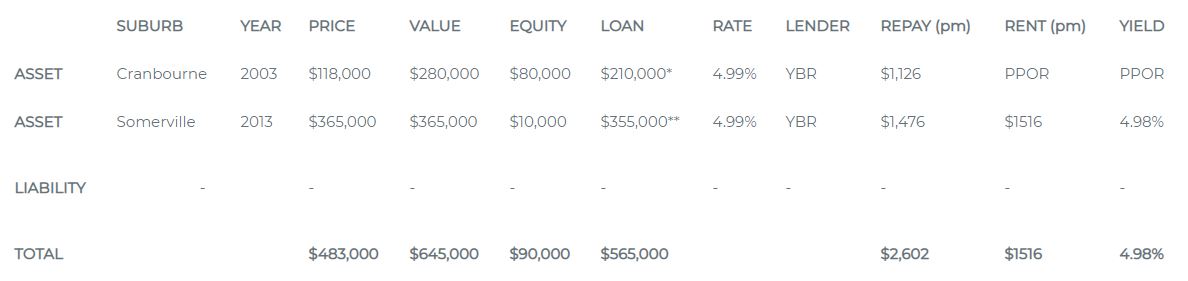

CURRENT POSITION REVIEW

*includes $20,000 debt consolidation + $10,000 stamp duty/costs + $20,000 deposit

**includes $10,000 lender’s mortgage insurance capitalised into the loan

- Total commitments after rent coming in are $1,172pcm

- Rachal now has $645,000 worth of property which at 7.2%pa average growth, will be worth $1.290 million in 10 years (this equals a $730,000 dollar uplift in her previous ‘safe’ position.)

- Her monthly cash flow has improved by $469 ($5628pa) through consolidating bad debt and sharpening home loan rates.

- Rachal will receive $5,500pa extra in her tax return from the benefits of depreciation and gearing, which is used to directly offset any shortfall from the rent.

CONCLUSION

So if you are a bit worried about investing and have a fear of the unknown please, consider Rachal’s story.

A single woman 40 years old who is looking forward to over $11,000pa extra cash and an uplift in equity position of $730,000 over the next 10 years! Yep, that’s an $840,000 dollar reward for overcoming her fear.

This is a great story to share as it is reflective of so many of our clients, please take the time to explore your position and unlock your potential.

David

PS: I’m working on getting Rachal to buy another property hopefully it doesn’t take as long this time…..

NOTE: the figures and analysis shown above features ‘approximates’ and rounding of numbers, and may not be accurate to apply to your own situation. Please consult one of our client managers for a detailed property investment analysis specifically for you.